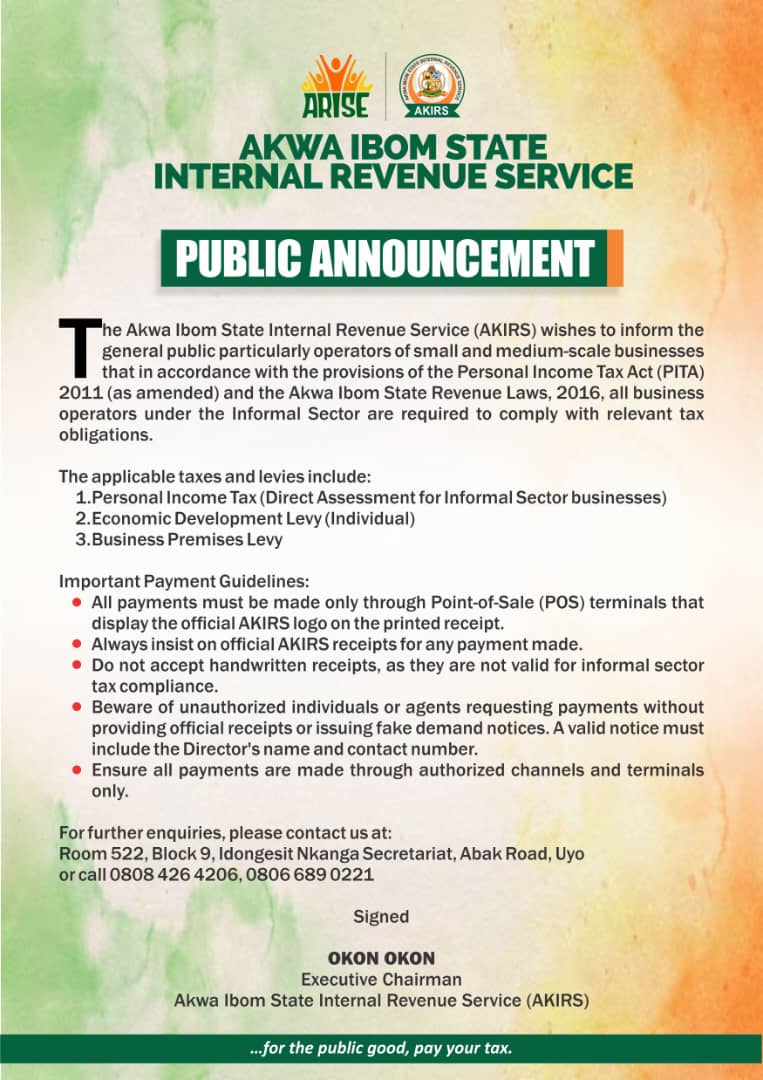

PUBLIC ANNOUNCEMENT

M

The Akwa Ibom State Internal Revenue Service (AKIRS) wishes to inform the general public particularly operators of small and medium-scale businesses that under the provisions of the Personal Income Tax Act (PITA) 2011 (as amended) and the Akwa Ibom State Revenue Laws, 2016, all business operators under the Informal Sector are required to comply with relevant tax obligations.

The applicable taxes and levies include:

1. Personal Income Tax (Direct Assessment for Informal Sector businesses)

2. Economic Development Levy (Individual)

3. Business Premises Levy

Important Payment Guidelines:

• All payments must be made only through Point-of-Sale (POS) terminals that display the official AKIRS logo on the printed receipt.

• Always insist on official AKIRS receipts for any payment made.

• Do not accept handwritten receipts, as they are not valid for informal sector tax compliance.

• Beware of unauthorized individuals or agents requesting payments without providing official receipts or issuing fake demand notices. A valid notice must include the Director’s name and contact number.

• Ensure all payments are made through authorized channels and terminals only.

For further enquiries, please contact us at:

Room 522, Block 9, Idongesit Nkanga Secretariat, Abak Road, Uyo

or call 0808 426 4206, 0806 689 0221

Signed

Okon Okon

Executive Chairman

Akwa Ibom State Internal Revenue Service (AKIRS)

…for the public good, pay your tax.